Smart Automation

Automate payments, save time, and stay worry-free.

Secure & Reliable

Bank-grade security you can always trust.

Growth Focused

Boost cash flow and scale your business faster.

We Don't just automate payments

We Do it in Smarter Way

Eazy Collect is a secure and reliable mandate management platform designed to simplify recurring payments for businesses and customers across India. With UPI Autopay and eNACH-based solutions, we enable businesses to create mandates, set up EMIs, and collect payments automatically, reducing manual work and improving cash flow efficiency by up to 95%.

At Eazy Collect, we aim to make digital collections faster, safer, and smarter. With features like quick registration, one-tap payments, EMI alerts, flexible EMI options, and secure KYC compliance, we eliminate the complexities of traditional collection systems and deliver a truly seamless experience.

Our mission is to empower businesses with automation, efficiency, and trust. By reducing delays, enabling faster collections, and offering actionable insights through dashboards, we help businesses scale with confidence and focus on growth while we handle their collections.

Our Features

Smart Tools for Smarter Payments

Auto Pay Deduction through UPI

Mandate Creation

EMI Alerts

EMI Tracker - Transaction Timeline

Flexible EMI Options

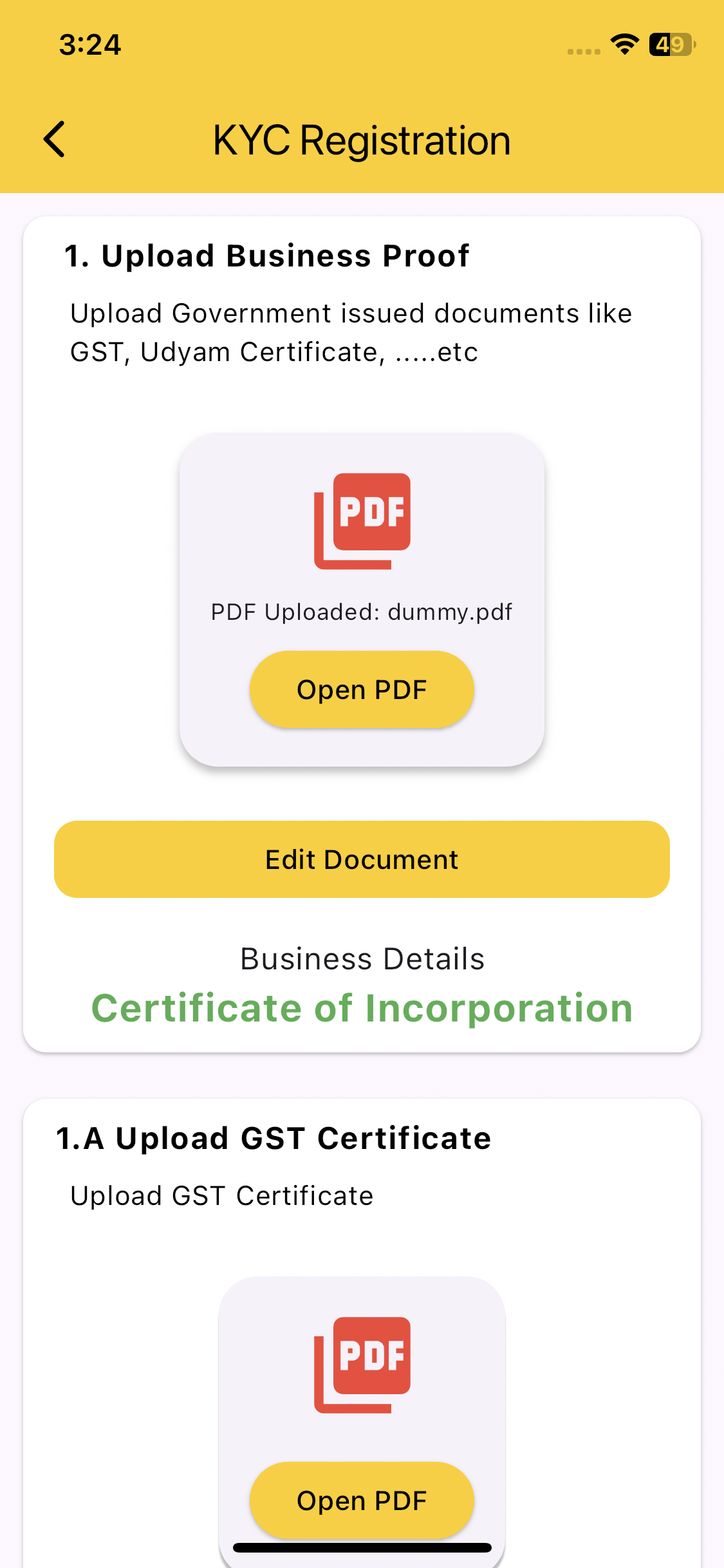

KYC

Our Services

Redefining Customer Experience with Smarter Services

Advanced Payment Security with UPI & e-NACH

Safeguard every transaction with bank-level encryption and compliance-ready frameworks. By integrating UPI and e-NACH, we eliminate risks of fraud or failed payments while giving your customers the convenience of trusted, widely accepted payment methods.

Real-Time Payment Monitoring

Get a 360° live view of every EMI and transaction with instant status updates. No more waiting for reconciliations or manual checks—our platform keeps you informed with real-time alerts, so you can identify delays, track successful payments, and make faster financial decisions.

Boost Cash Flow Efficiency by 90-95%

We empower businesses with automated collections, instant settlements, and predictable revenue flows. By reducing late payments and defaults, our system drastically improves working capital and ensures money moves faster—strengthening your cash flow like never before.

Lightning-Fast Business Onboarding

Forget about lengthy paperwork and complicated approvals. With our digital-first onboarding, your business can go live within minutes. Whether you're a startup or an enterprise, we make registration effortless so you can start collecting payments without delays.

Seamless EMI Setup & Management

Offer flexible EMI solutions tailored to your customers' needs. With just a few clicks, you can create, track, and manage EMIs across multiple plans—monthly, quarterly, or custom. This not only improves customer convenience but also builds long-term loyalty.

One-Tap Payment Convenience

Revolutionize the way your customers pay their EMI. With our frictionless one-tap payment system, users can complete transactions within minutes which instantly—boosts payment success rates while enhancing your customer satisfaction.

Frequently Asked Question

Find answers to all your questions

How to Use

Eazy Collect Application

Step 1: Download the Eazy Collect App

Get the app from the Play Store to begin your setup.

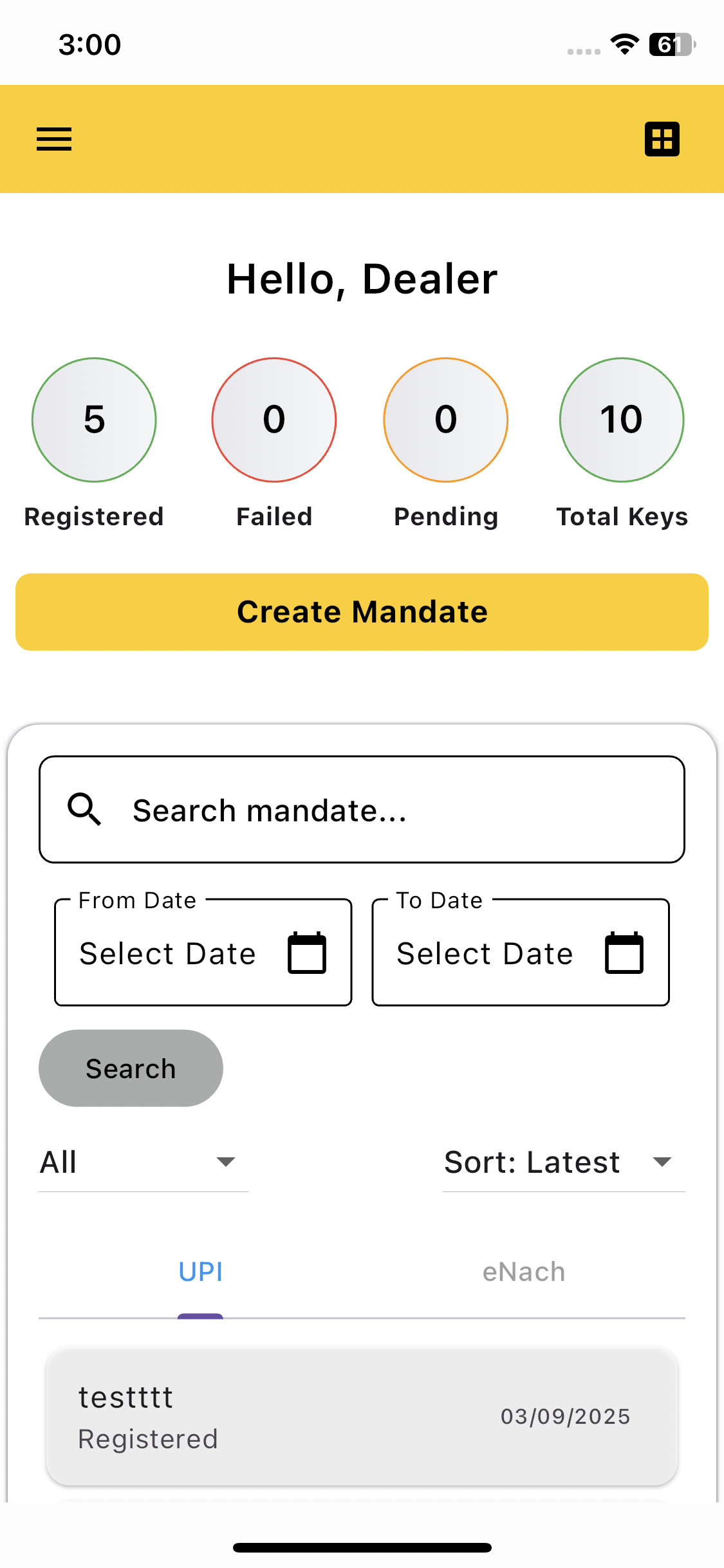

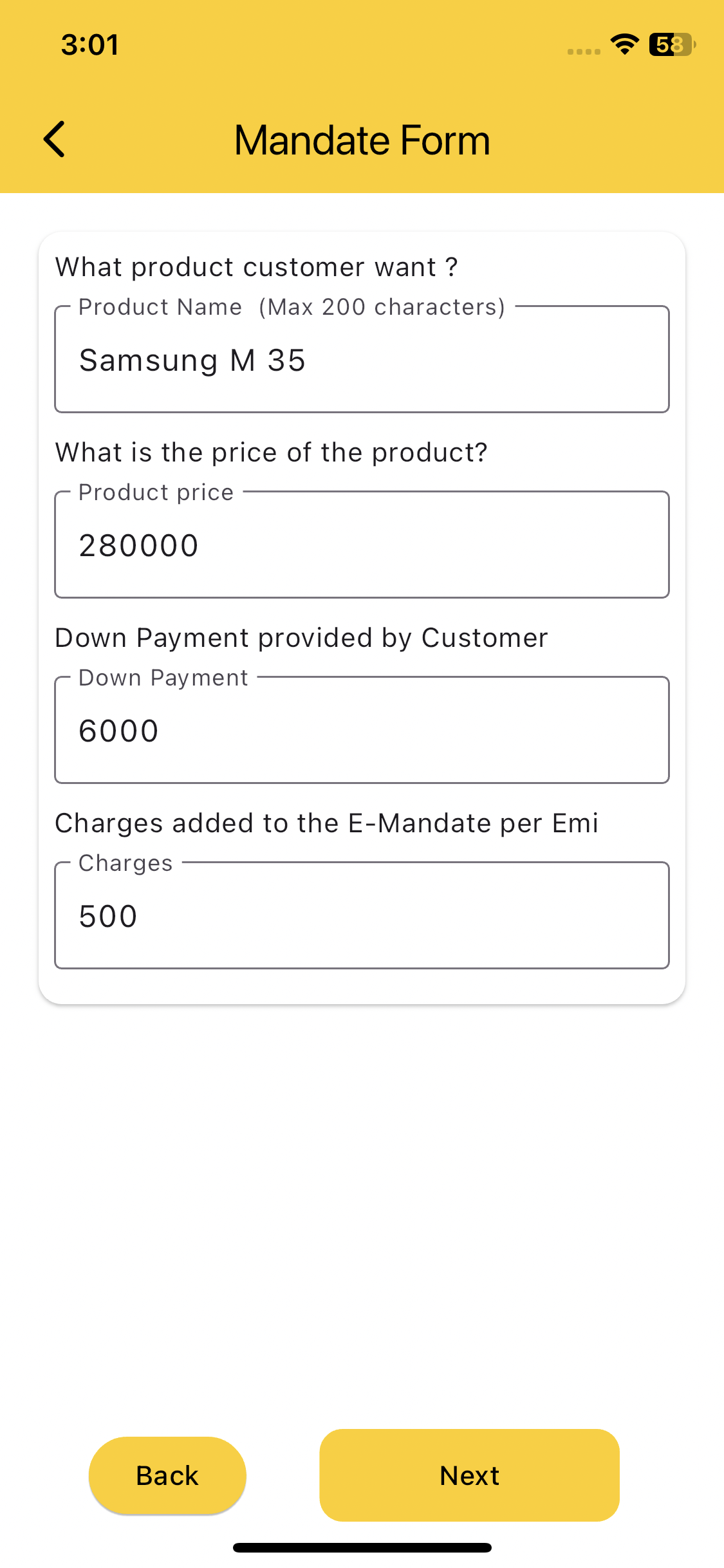

Step 2: Create an e-Mandate

Enter customer and payment details such as total amount, collection date, and number of installments. The system will generate an automatic e-Mandate.

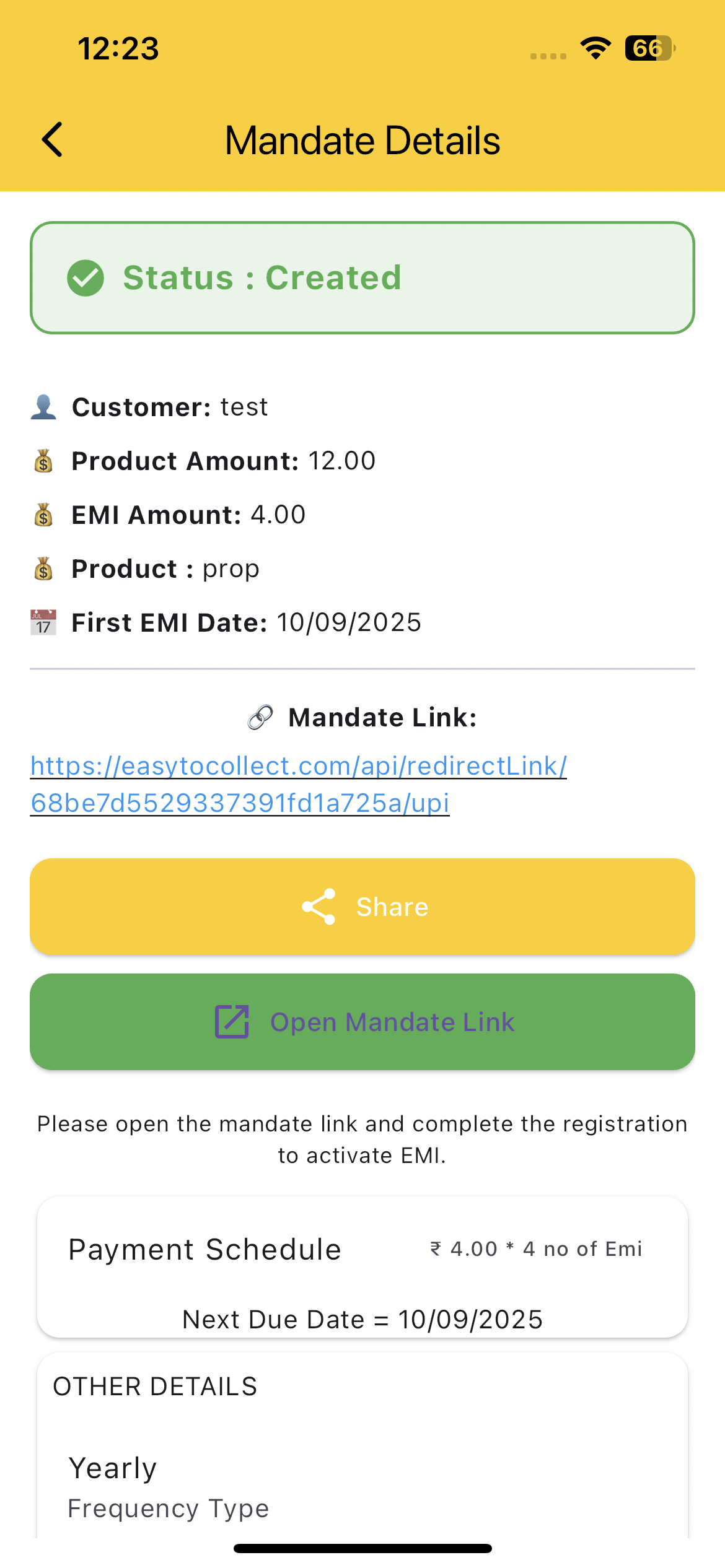

Step 3: Share the Mandate Link

Send the mandate link to your customer through WhatsApp. Customers can authorize payments via UPI, Net Banking, or Debit Card.

Step 4: Receive Payments Automatically

Payments are deducted from the customer's bank account and transferred directly to your account on the scheduled dates.

Step 5: Track All Transactions

View complete payment history and upcoming collections in one place for better visibility and control.